Friday, April 26, 2024

I Dare You

The Regrettes

Why they hide for 17 years

From the pen of Pedro X Molina

Remember Mike Pence ?

From the pen of Chris Britt

Hm-m.The owner does work for a foreign country

From the pen of Steve Breen

Send a copy to SCOTUS

From the pen of Clay Bennett

They all look alike

From the pen of Nick Anderson

One preacher undestands Trump's con

Tennessee Brando

No matter how hard his SCOTUS plants try

MAGAts are keenly aware of the danger

Turn, turn, turn

He sees the hazard

Nancy has RTS by Proxy

It will be an official act in a Trump dictatorship

Thursday, April 25, 2024

Give Me A Reason

The Tibbs

The solution is at hand

From the pen of Jen Sorensen

They know, they went to school

From the pen of Jack Ohman

Give it a try

From the pen of Pedro X Molina

From up there they all look alike

From the pen of Marty Two Bulls

He counts lies to go to sleep

From the pen of John Deering

Cancun ain't cheap

From the pen of Nick Anderson

Kimmeling along

Jimmy Kimmel

In his every word and action

With so many things happening at once,

If it works...

The polite way to say, He Fucked Up Bigly.

Time for him to lose

Texas has no taco problem

Wednesday, April 24, 2024

Night Rider's Lament

Nanci Griffith

She is definitely not his type

From the pen of Kevin Necessary

Moscow Marge meets her contact

From the pen of Clay Jones

The Secret Service can stand down

From the pen of Matt Davies

What gets old dogs excited

From the pen of Tim Campbell

He's hot shit.

From the pen of Chris Britt

What DOES he have to do ?

From the pen of Nick Anderson

Kimmel does Donny to a crisp

Jimmy Kimmel

In the author's own words

The flags tell all

Practicing what they preach

Don't Bees for adults

How they find their way

Gomer Comer's Crimes

Tuesday, April 23, 2024

Hammond Song

The Roches

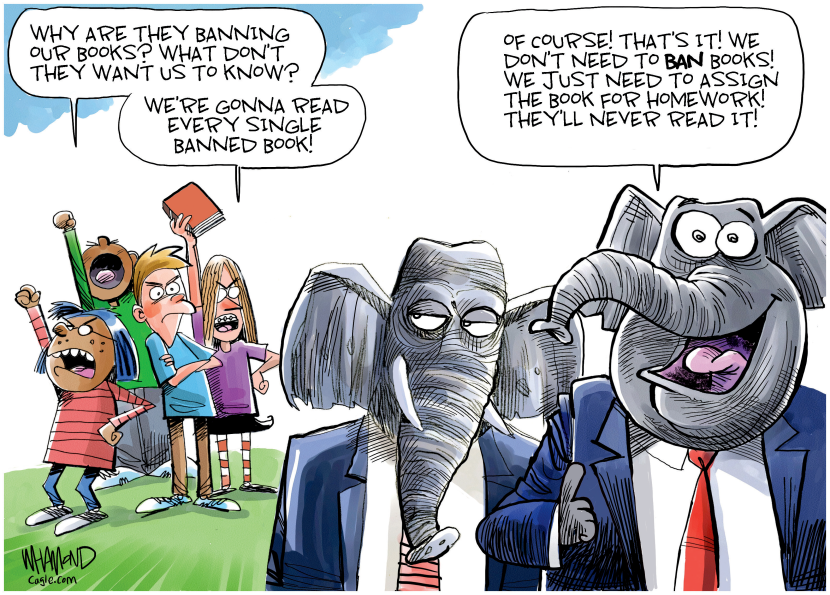

If Republicans were smart

From the pen of Dave Whamond

First things first

From the pen of Joel Pett

Arizona, The Land Time Wants To Forget

From the pen of Lalo Alcaraz

Rip van Stinkle's Contempt Defense

From the pen of Bill Bramhall

Mike Bunyan, Paul's Little Brother

From the pen of Robert Ariail

Moscow Marge's Thought Path

From the pen of Nick Anderson

Mr. Trump whines and farts

Jimmy Kimmel

The reality

He grows louder by the day

And now his pecker will do him in

Just waiting to make it official

A reminder

Monday, April 22, 2024

Heartbeats Accelerating

Linda Ronstadt

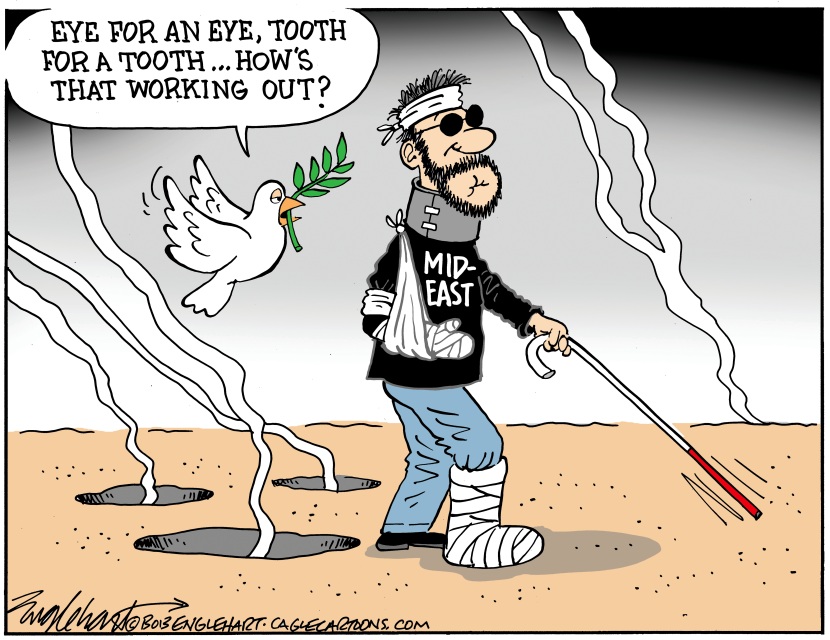

Time for a better way

From the pen of Bob Englehart

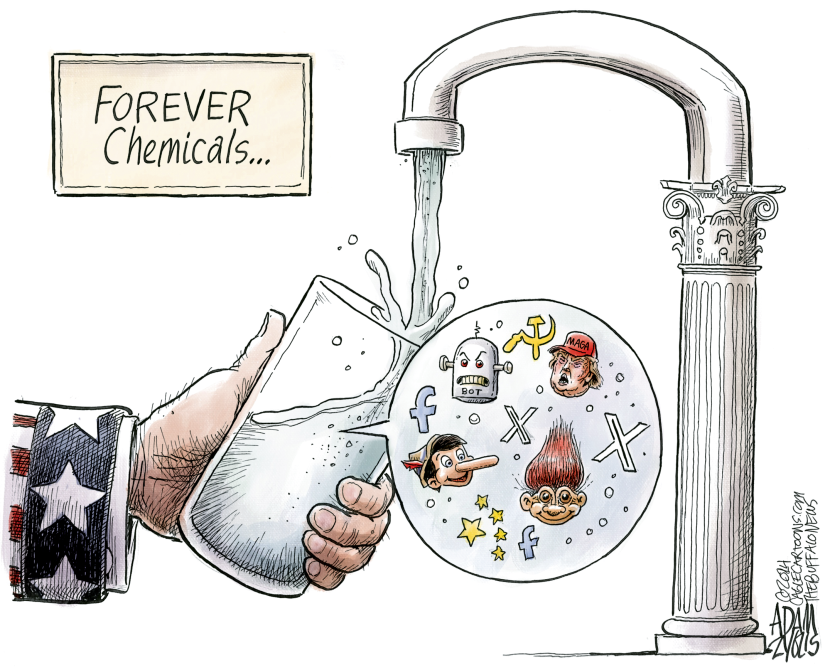

The slow poisons

From the pen of Adam Zyglis

Going for the rape tourist dollars

From the pen of Ted Rall

Getting his cell ready

From the pen of Jeff Danziger

Subscribe to Posts [Atom]